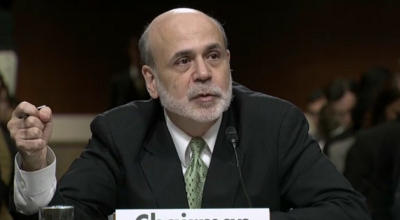

Fed Chairman Short on Answers About Economy

The health of the U.S. economy took center stage Thursday as Federal Reserve Chairman Ben Bernanke testified before Congress.

Lawmakers asked tough questions about the Fed’s policy on spending and taxes, the Euro crisis and banking reform.

The hearing comes two months after the Fed predicted the economy would grow and the unemployment would drop. But just the opposite has happened.

Last week’s job numbers were anemic, adding only 69,000 to the workforce and edging the unemployment rate up. In addition, the U.S economy grew at only 1.9 percent in the first three months of this year.

So, Washington was waiting to hear what prescriptions Bernanke has for turning the economy around. As is often the case, his testimony was vague.

“As always, the Federal Reserve remains prepared to take action as needed to protect the U.S. financial system and economy in the event that financial stresses escalate,” Bernanke told lawmakers.

Sen. Jim DeMint, R-S.C., voiced the concern many conservative lawmakers hold that President Obama is telling Europe to spend its way out of the current debt crisis, a crisis that could disturb the U.S. economy.

DeMint questioned Bernanke about mixed signals coming from the Fed.

“On the one hand, you’re telling us that this debt is creating a potentially huge crisis,” Sen. DeMint said. “Yet, you’re telling us we need to keep spending, with more debt. What is the real signal here?”

“Well, first of all, it’s not necessarily more spending. Appropriate tax relief would also help, in the same way,” Bernanke replied.

“I would say a do-no-harm policy is what I’m looking for here, at least avoid derailing the recovery in the short term, but combine that with a strong and credible plan for reducing the deficit in the medium term,” he continued.

Signals that Europe is planning to intervene to help solve Spain’s enormous debt burden has helped rally world markets. Some analysts also believe the victory of Scott Walker in Wisconsin’s gubernatorial recall election may be helping to boost the Dow Jones.

Bernanke’s testimony that the Fed is trying to “do no harm” appears to have sent the markets a message they can live with, at least for now.

Still, some analysts are hoping that the Fed will take more action to try to stimulate the economy if it weakens even more.

But even if the Fed does act, the White House and Congress don’t have many options left to try to strengthen the economy before the elections.

Meanwhile, across the country employers are still cautious to hire people and invest their companies.

“They’re staying more focused on driving productivity and increasing their revenue and profits,” Joanie Ruge, employment analyst with Randstad Holding U.S., explained.

Then there are those expected tax increases at the first of the year. President Obama opposes extending all the Bush-era tax cuts beyond 2012.

“A tax hike of that size for just one year is simply unprecedented,” Curtis Dubay of the Institute for Economic Policy said.

“It’s going to take an enormous chunk of the economy out of the hands of the businesses and people and families that earned the income and give it to Congress to spend,” he said.

Those concerns coupled with a potential slowdown in China and a Europe that appears to be on the brink of economic calamity, are only adding to the anxiety.

“That global environment across the three main engines of the global economy is looking a lot weaker than a month ago,” Adam Boyton, an analyst with Deutsche Ban, said.