Mat Staver: Churches Need to Replace the Muzzle With a Megaphone

In 1954, then-Sen. Lyndon B. Johnson introduced an amendment to the U.S. Tax Code that prohibits 501(c)(3) tax-exempt organizations—that includes churches—from engaging in political campaigns.

The IRS “clarifies” the Johnson Amendment with the following “advice” for nonprofits:

Under the Internal Revenue Code, all section 501(c)(3) organizations are absolutely prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for elective public office. Contributions to political campaign funds or public statements of position (verbal or written) made on behalf of the organization in favor of or in opposition to any candidate for public office clearly violate the prohibition against political campaign activity. Violating this prohibition may result in denial or revocation of tax-exempt status and the imposition of certain exercise taxes.

Certain activities or expenditures may not be prohibited depending on the facts and circumstances. For example, certain voter education activities (including presenting public forums and publishing voter education guides) conducted in a non-partisan manner do not constitute prohibited political campaign activity. In addition, other activities intended to encourage people to participate in the electoral process, such as voter registration and get-out-the-vote drives, would not be prohibited political campaign activity if conducted in a non-partisan manner.

On the other hand, voter education or registration activities with evidence of bias that (a) would favor one candidate over another; (b) oppose a candidate in some manner; or (c) have the effect of favoring a candidate or group of candidates, will constitute prohibited participation or intervention.

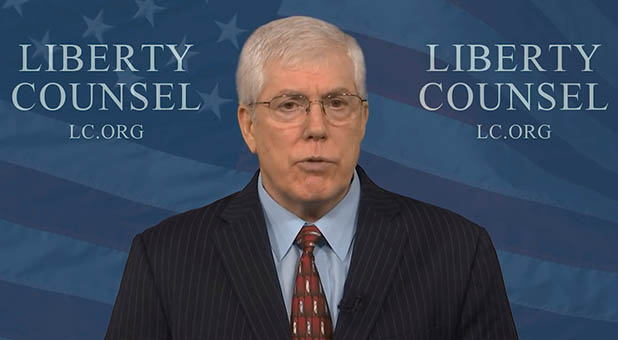

But Mat Staver, founder and chairman of Liberty Counsel, says no church has ever had its tax-exempt status challenged for speaking out on matters of American politics. In a video he’s sharing with pastors around the country, he said it’s time to take off the muzzle and pick up a megaphone.

“I want to take away the fear that you may have regarding tax-exempt status and political intervention,” he said. “No church has ever lost its tax-exempt status for lobbying or for political intervention. The lobbying restriction came into the IRS code in 1934 and no church has ever lost its exemption for supporting or opposing local, state or federal legislation.

“In 1954, the political intervention restriction came into the IRS Code. It says that churches may not support or oppose candidates for office. That’s an absolute prohibition, but again, no church even for that has ever lost its tax-exempt status for supporting or opposing a candidate.”

Staver then examines a specific example in which a church opposed then-Arkansas Gov. Bill Clinton during his presidential bid. The church spent thousands of dollars running full-page ads in newspapers throughout the country.

After the election, and Clinton had won, the IRS came knocking at the church’s door. But even then, when the church had clearly violated the Johnson Amendment, it still didn’t lose its tax-exempt status.

“Clearly churches can—even within the parameters of the IRS restrictions—address biblical topics,” he said. “Pastors can preach on any topic at any time no matter whether this is a political discussion at that moment.”

He then goes on to identify all of the ways pastors can be engaged in the political process without violating the Johnson Amendment.

“Clearly you can do a lot with regards to taking positions for or against local, state or national legislation or laws, and you can also speak specifically with regards to the biblical issues of the day,” he added. “Educate your people, get them registered to vote, and educate them on how these candidates stand on these biblical issues.”